Go paper-free

Amend paper-free preferences for your statements and correspondence.

You want a financial plan where your money works as hard as possible for you. We can help you look at the financial options available and make sure you are happy with your current choices.

We all have different targets in life. Having a clear idea of what your goals are, is something that can help you with your financial decision making.

Work out how much time you have to reach your goals. This can help you structure your plan, and decide where best to put your money.

Where you put your money will depend on the amount of risk you are willing to take and how long you can leave your money invested for. How do you want to balance the risk with the potential for higher returns?

A well-balanced plan should include stocks and shares. Ready-made investments can make the stock market feel more accessible. This type of investment is a combination of investments and can be selected based on the level of risk you are willing to take.

Investments are not guaranteed to rise, their value can also fall, which means that you could get back less than you invested. Therefore, you should look to leave the money you invest in for at least 5 years. This will help to balance any market changes and give you a better opportunity for growth.

If you would like to know more about your options, you could speak to a financial advisor, but there may be a charge for this.

You may also have to pay tax on your investments but this will depend on your personal circumstances and may be subject to change.

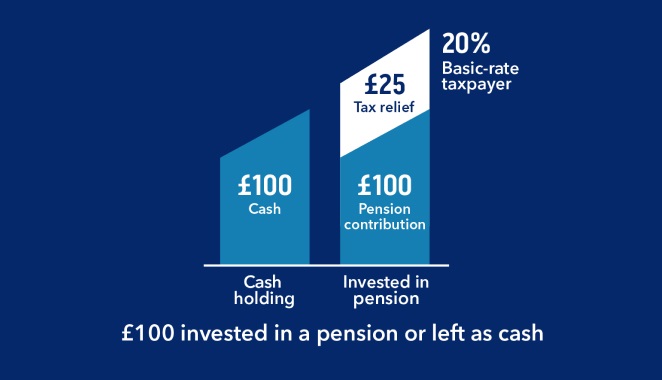

Adding to your pension can be a great way to plan for your retirement and you could benefit from tax relief on what you pay in. For example, if your basic rate of tax is 20%, the Government will top up your pension with an additional £25 for every £100 you pay in.

Higher-rate tax payers could also benefit from additional tax relief, which can be claimed directly from HM Revenue & Customs.

To save enough money for your retirement, the 2024 Scottish Widows Retirement Report recommends that you should save at least 12% of your income. If you have a workplace pension, your employer may match some or all of your contributions. But there are limits to how much you can pay into a pension in a tax year and still receive tax relief on. Tax treatments depend on individual circumstances and may also be subject to change.

It’s also worth knowing that any money you put in your pension is locked away until you’re at least 55 years old (increasing to 57 in April 2028). Therefore, consider your options if you think you may need to access this money sooner.

If you have a mortgage, you might hope to pay it off early. While this is a good idea, it may be worth paying off any other debts you have first, especially if they have higher interest rates.

If you have a fixed-rate mortgage, you may face higher repayments when it runs out. So, if you can, try to reduce your outstanding balance while your interest rate is low. This would reduce some of the impact if your mortgage rate rises in the future.

It’s worth checking to see if you have any Early Repayment Charges. Many mortgage lenders will allow a maximum of 10% overpayment each year.

Savings are an important part of a financial plan. They can give you security, easy access and steady growth. They can also give peace of mind in case of emergencies.

Having a savings fund equal to around 3 to 6 months of outgoings is a good target to have for a savings plan.

When saving, look for the best easy-access savings rate. Or, if you don’t need to access your cash for at least 12 months, it may be worth considering a fixed-rate savings account.

This will be personal to you. You may already have a plan that doesn’t need to change, or you might need to make or adjust your plan. The important thing is to have a plan that works for you.

Think about:

Find out more about what rising inflation could mean for your savings.

Whether it's budgeting and saving, or helping someone else, we have tips and tools to help you.

We are by your side and have a range of support available for you.