Go paper-free

Amend paper-free preferences for your statements and correspondence.

Inflation can rise and fall. But what exactly is it? We can help you understand this and how it can impact your financial goals.

Inflation is the term given to describe rising prices. The Office for National Statistics calculates the rate of inflation by comparing the average cost of goods and services (or basket) of items today, against their price this time last year.

So, if a pint of milk cost £1 this time last year, and costs £1.03 this year, then the rate of inflation is 3%.

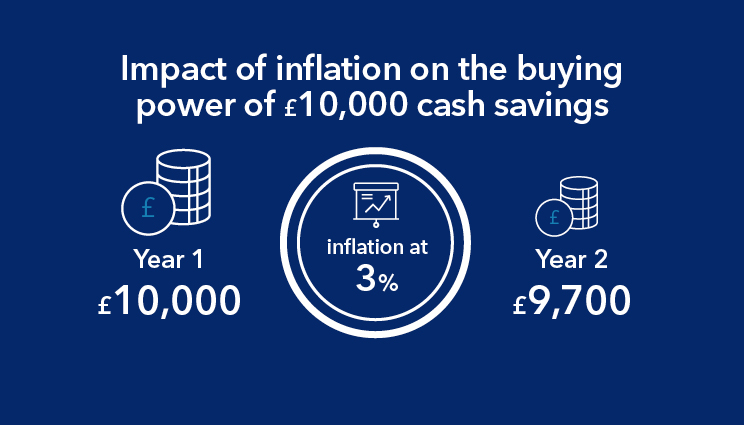

The rate of inflation affects the value of your money. If prices are going up, you won’t be able to buy as much with your earnings or savings.

This illustration shows how inflation can impact your savings if inflation was at, for example, 3%.

You can find the latest inflation information at the Office for National Statistics. It is also worth remembering that the rate of inflation can rise and fall.

If you want to find out how inflation will affect your savings, enter an amount, along with the current inflation rate. We’ll then tell you the future buying power of your money, based on the rate remaining the same for the next year.

The calculator is an estimate. It does not include interest you could earn over time. The rate of inflation can rise and fall.

For an up-to-date view, visit the Office for National Statistics.

We have support and guidance to help see if your current financial choices are still right for meeting your goals.

Whether it's budgeting and saving, or helping someone else, we have tips and tools to help you.

We are by your side and have a range of support available for you.