Go paper-free

Amend paper-free preferences for your statements and correspondence.

Let's break it down. Smart decisions start with understanding your options.

Start the new 2025/26 tax year off by using your £20,000 ISA allowance. Take a look at our ISAs and see how you can benefit from tax-efficient saving.

Tax treatment depends on individual circumstances and may change in the future.

Depending on your financial goals, a combination of saving and investing could help you to reach them.

Only you can know if the best option is to save, invest, or do a bit of both. But some insight could help.

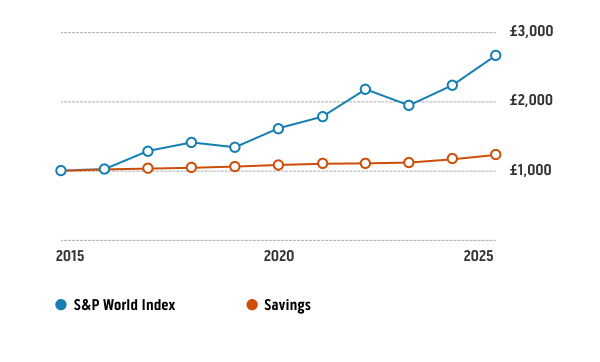

The following table compares the performance of cash savings alongside investments over a 10-year period. Obviously, that doesn’t mean the same will be true in future, but it’s interesting all the same.

Savings – MoneyFacts, 12m fixed non ISA rates, January 2025.

Investments – S&P Dow Jones Indices, S&P World Index (GBP). Excludes fees and does not include any dividends or reinvestment.

These figures refer to the past and past performance is not a reliable indicator of future performance. See a data breakdown of the performance in the table here. See a data breakdown.

The government sets a limit on how much interest or returns you can make from your savings or investments before you pay tax. This limit can change. ISAs protect you from paying tax on any interest you make with savings, as well as protecting investments from Capital Gains Tax, UK Income Tax and tax on dividends.

Look at our guides to learn more.

It’s sensible to put some money aside as a safety net if there's an emergency. You can use it to cover your regular outgoings for a few months.

Also, if you’re paying more interest on debts than you would be earning on a savings or investment account, aim to repay those debts first.

Make the most of this year’s ISA allowance with ISAs that work for you.

Wherever you are in life, a financial plan can be your way forward.

However experienced you are, it's always good practice to make informed decisions.

Bank of Scotland Share Dealing Service is operated by Halifax Share Dealing Limited. Registered in England and Wales No. 3195646. Registered Office: Trinity Road, Halifax, West Yorkshire HX1 2RG. Authorised and regulated by the Financial Conduct Authority under registration number 183332. A Member of the London Stock Exchange and an HM Revenue & Customs Approved ISA Manager.