Go paper-free

Amend paper-free preferences for your statements and correspondence.

By making the most of tax relief and allowances, you can maximise your retirement savings to help secure a comfortable future.

One of the main benefits of saving into a pension is the tax relief you get from the Government. This means when you pay money you’ve earned into a pension, the income tax you’ve paid on that money is essentially returned via a government top-up (known as tax relief). This is subject to a limit known as the Annual Allowance.

This tax relief helps you grow your pension’s value faster over time, which makes it one of the smartest ways to save for later life. Let’s look at how it works.

The amount of tax relief you get depends on the level of income tax you pay. Here’s a quick overview for a personal pension:

*If you have a workplace pension, depending on the type, you may find that your full tax relief has already been applied to your contributions for you by your employer. You should check with your employer if unsure.

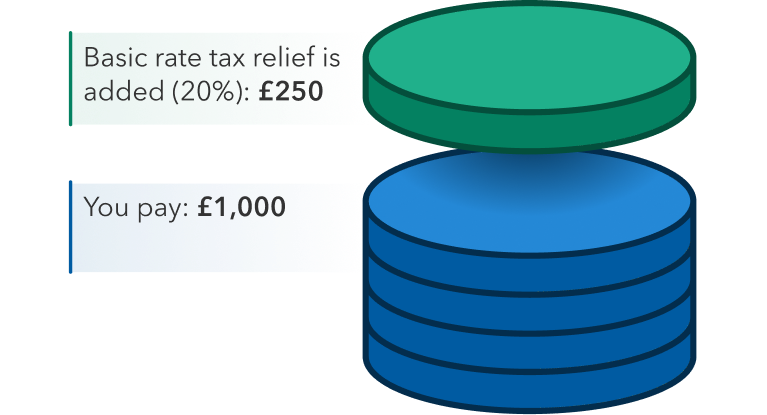

Here’s how tax relief works when you’re saving into a personal pension if you wanted to contribute a total of £1,250 into your pension for example:

Total contribution of £1,250

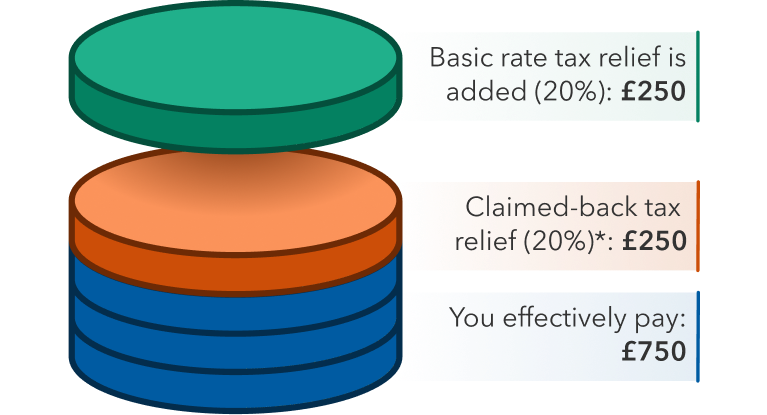

Total contribution of £1,250

*By claiming back the additional 20% higher rate tax relief through self-assessment, this effectively means you’ve only paid £750 towards a £1,250 total pension contribution. If you live in Scotland, or are an additional rate taxpayer, the reclaimed tax amount could be more.

This is why higher and additional rate taxpayers, who are saving into a personal pension, should remember to complete a Self-Assessment to claim back the tax relief they’re entitled to.

A pension is a powerful way to save because the added tax relief boosts its value. Over time this compounding effect can really add up. It makes sense to start a pension as early as you can – to benefit from as many years of tax relief as you can – and keep it invested for as long as possible. The more time it’s invested, the more opportunity it has to grow. And it’s never too late to start.

Pensions are an attractive investment option for long-term retirement planning in two main ways:

How you receive the pension tax relief you’re entitled to depends on the type of pension you’re paying into:

If you’re contributing to a personal pension and are a higher or additional rate taxpayer (so paying more than 20% tax), you need to claim the additional tax relief you’re entitled to on these contributions through the annual Self-Assessment process. You can choose to take this as tax rebate, an adjustment to your tax code, or a reduction in your overall tax bill.

Workplace pensions often operate a Net Pay scheme. This means your employer deducts your pension payments from your gross salary (before you pay tax), and you only pay tax on what is left. Your employer does this for you and it shows in your pay cheque. This ensures you receive the right level of tax relief, no matter which tax band you are in, without having to claim anything back from HMRC.

The income tax bands for England and Wales for 2025/2026:

|

Band |

Taxable income |

Tax rate |

|---|---|---|

|

Band Personal Allowance |

Taxable income Up to £12,570 |

Tax rate 0% |

|

Band Basic rate |

Taxable income £12,571 to £50,270 |

Tax rate 20% |

|

Band Higher rate |

Taxable income £50,271 to £125,140 |

Tax rate 40% |

|

Band Additional rate |

Taxable income over £125,140 |

Tax rate 45% |

There are limits on how much tax relief you can get each year. This annual allowance applies across all your pension contributions. It affects how much you or anyone else paying into a pension on your behalf (for example your employer) can pay into it without a tax charge.

For the tax year 2025/2026, your allowance is the lowest of the following:

Your allowance resets each tax year. It’s also possible to ‘carry forward’ your last three year’s allowances to add to this year’s. You’ll need to contact HMRC to do this.

There are some other circumstances where your annual allowance may differ. These are:

Very high earners have a lower annual allowance, called the Tapered Annual Allowance. The taper applies if your 'threshold income' (your annual income before tax less any personal pension contributions and ignoring any employer contributions) is over £200,000. If your threshold income is above this, then you need to check if your 'adjusted income' (your annual income - including dividends, savings interest and rental income - before tax, plus the value of your own and any employer pension contributions) is over £260,000.

If it is, the annual allowance will reduce. If it is above £260,000, the annual allowance will reduce by £1 for every £2 that your ‘adjusted income’ exceeds £260,000. The maximum reduction is £50,000 once adjusted income reaches £360,000.

Please speak to your financial adviser for more details. You can find more information at www.moneyhelper.org.uk

If you withdraw money flexibly from a pension you will also be subject to a reduced annual allowance, which is currently £10,000. This is called the Money Purchase Annual Allowance (MPAA). You will have been told by your pension provider if the MPAA applies to you and to notify your other pension providers within 91 days or you could be subject to a fine.

Being self-employed means taking care of your pension yourself. Take control of your retirement.

For an easier way of saving for your retirement, see how our Ready-Made Pension could help.

Retire your way with a SIPP: Flexible, tax-efficient, and fully in your control.