Go paper-free

Amend paper-free preferences for your statements and correspondence.

Investment funds built and managed by our experts. They can be great when you want to start investing, have limited time to research the market or aren’t sure which funds to pick. We do the hard work so you don’t have to.

Currently for existing Bank of Scotland customers only.

It's easy to get started, just open your account today.

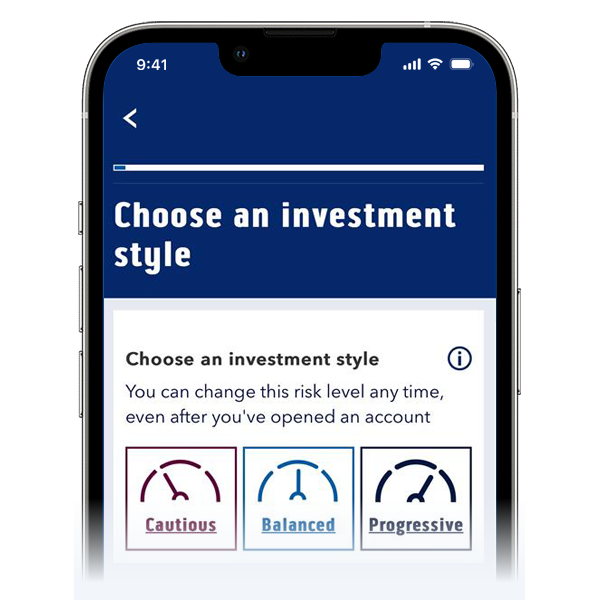

You can pick from three options to best suit you – cautious, balanced or progressive. And you can change this in the future if your circumstances or view of risk changes.

Open an Investment ISA, our tax-efficient way to start investing, or an Investment Account if you’ve already used your ISA allowance.

Starting from £50 a month or £500 as a lump sum.

Track and top up your ready-made portfolio using Internet Banking or our app. Just like your everyday banking.

When investing, it’s important to know the level of risk you’re taking.

Learn more about risks and how to understand them.

Our lowest risk fund. Your investments could still go down as well as up, but are generally more stable.

Account fee: £3 a month

Ongoing charge: 0.23%

Transaction costs: 0.11%

Our medium risk fund. It is aimed at growing investments steadily, but there may be some more notable ups and downs.

Account fee: £3 a month

Ongoing charge: 0.24%

Transaction costs: 0.12%

Our medium-high risk fund in our Ready-Made Investment portfolio. If you’re willing to accept a higher level of risk for the chance of greater returns.

Charges

Account fee: £3 a month

Ongoing charge: 0.22%

Transaction costs: 0.12%

Key documents

For more information about the three funds, you can read our fund range and investments guide (PDF, 243KB). It contains details of how the funds are managed, their objectives and risks, and a detailed breakdown of the charges.

Investments are sold at a minimum value of £10. All remaining sales proceeds, after the £3 fee has been paid, will be held as cash in your account and will be used to contribute to future monthly fees.

The data in the below table and performance chart refer to the past, and past performance is not a reliable indicator of future results. The performance data includes the ongoing charge and all transaction costs within the fund, but does not include the £36 account fee.

Source of data: FE Fundinfo

The above graph shows the percentage change of the funds since launch. This is to help you understand how the funds have performed over the longer term.

Please remember that the data in the above performance graph and the below table refer to the past, and past performance is not a reliable indicator of future results.

The last available price for each fund is shown below the graph and this is usually the price from the previous trading day. If you decide to invest in one of our funds, your trade will be sent to the Fund Manager and you will get the price given on the next available valuation point for this fund, which could be higher or lower than the price shown above.

|

Date |

Cautious |

Balanced |

Progressive |

|---|---|---|---|

|

Date 31st Dec 2022 – 31st Dec 2023 |

Cautious 8.6% |

Balanced 9.9% |

Progressive 11.0% |

|

Date 31st Dec 2021 – 31st Dec 2022 |

Cautious -12.3% |

Balanced -8.9% |

Progressive -7.0% |

|

Date 31st Dec 2020 – 31st Dec 2021 |

Cautious 3.5% |

Balanced 8.2% |

Progressive 12.5% |

|

Date 31st Dec 2019 – 31st Dec 2020 |

Cautious 4.0% |

Balanced 2.3% |

Progressive 1.9% |

31st Dec 2018 – 31st Dec 2019: Our funds weren’t launched until 16th September 2019.

There is a flat-rate account fee of £3 a month.

Ongoing charge and Transaction costs are calculated on an ongoing basis and built into the value of the fund.

|

If your investment was worth |

Cautious (£3 monthly + 0.34%) |

Balanced (£3 monthly + 0.36%) |

Progressive (£3 monthly + 0.34%) |

|---|---|---|---|

|

If your investment was worth £1,000 |

Cautious(£3 monthly + 0.34%) £39.40 |

Balanced(£3 monthly + 0.36%) £39.60 |

Progressive(£3 monthly + 0.34%) £39.40 |

|

If your investment was worth £5,000 |

Cautious(£3 monthly + 0.34%) £53.00 |

Balanced(£3 monthly + 0.36%) £54.00 |

Progressive(£3 monthly + 0.34%) £53.00 |

|

If your investment was worth £10,000 |

Cautious(£3 monthly + 0.34%) £70.00 |

Balanced(£3 monthly + 0.36%) £72.00 |

Progressive(£3 monthly + 0.34%) £70.00 |

|

If your investment was worth £20,000 |

Cautious(£3 monthly + 0.34%) £104.00 |

Balanced(£3 monthly + 0.36%) £108.00 |

Progressive(£3 monthly + 0.34%) £104.00 |

A fund is a collection of assets created by investment experts (Fund Managers). These can be made up of shares, bonds, property or even cash.

Investing in a fund with a wide range of assets could offer potential growth over time, while also helping to reduce any risk.

Terms and Conditions (PDF, 217KB)

Key features document Investment ISA (PDF, 145KB)

Key features document Investment Account (PDF, 137KB)

Want to start investing but not a Bank of Scotland customer yet?

Get started with one of our accounts.

We’ve created a simple five-step guide to help you decide if investing works for you.

Understanding risk and reward is crucial to investing. Read our article to learn more.

We have a range of easy-to-read content to grow your confidence in investing.

Our Ready-Made Investments are provided by Embark Investment Services Limited and are protected up to a total of £85,000 by the Financial Services Compensation Scheme.

Investments with Bank of Scotland Share Dealing are protected up to a total of £85,000 by the Financial Services Compensation Scheme. This limit is applied to the aggregated total of any stock or cash held across the following brands which we administer.

You can review your account by Logging in or view your charges on our Online Investments page.

Bank of Scotland Share Dealing Service is operated by Halifax Share Dealing Limited. Registered in England and Wales No. 3195646. Registered Office: Trinity Road, Halifax, West Yorkshire HX1 2RG. Authorised and regulated by the Financial Conduct Authority under registration number 183332. A Member of the London Stock Exchange and an HM Revenue & Customs Approved ISA Manager.