Go paper-free

Amend paper-free preferences for your statements and correspondence.

Looking for expert investment advice? Try our Digital Advice Service today.

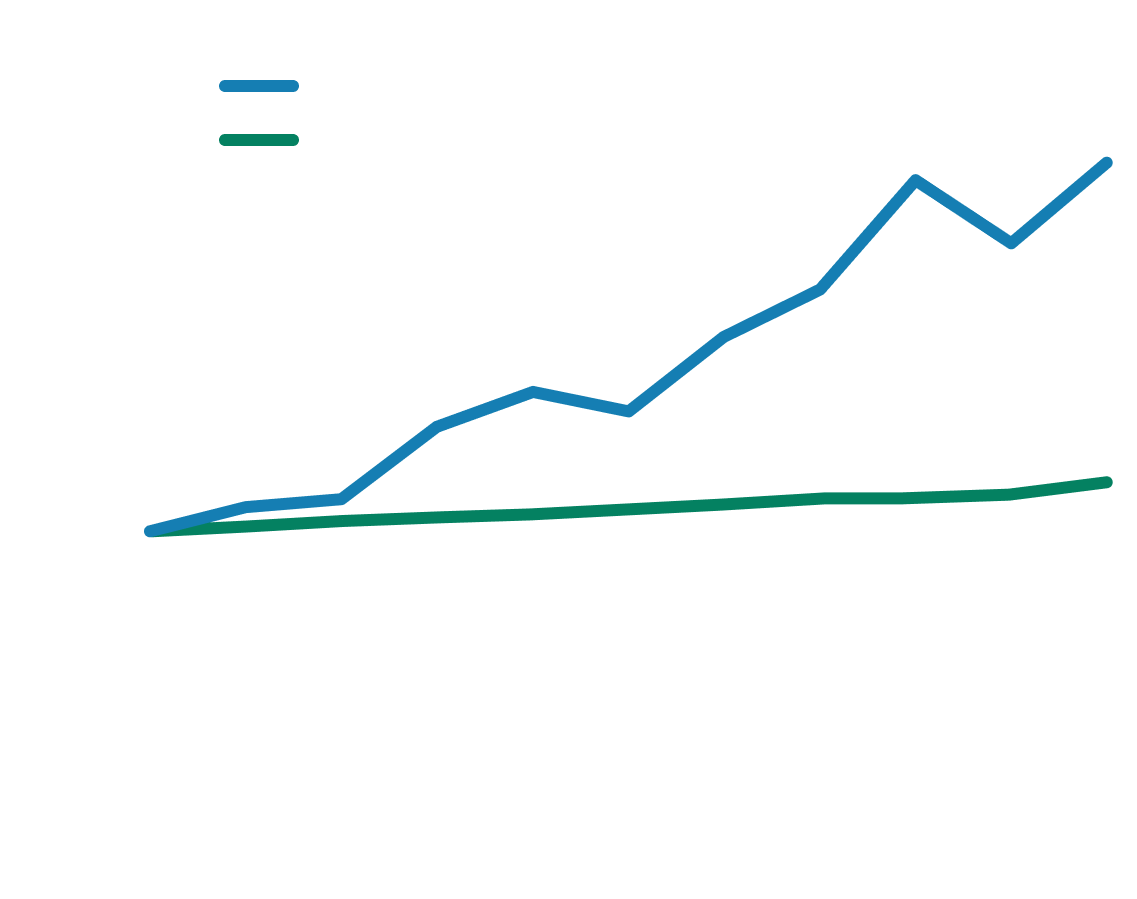

If you’d have invested £1,000 in a fund tracking the S&P World Index (it tracks medium to large companies across 24 developed markets) in 2014, it would have been worth £2,466 in January 2024.

Whereas £1,000 kept in a typical savings account would be worth £1,189 today.

Source: (Savings) MoneyFacts 12m Fixed Non-ISA rates (decile 2), January 2024. (Investments) S&P Dow Jones Indices, S&P World Index (GBP).

Data is based on an initial investment/deposit value of £1,000 and held over a 10-year period between 01/01/2014 and 01/01/2024.

Excludes fees. Past performance is not a reliable indicator of future performance.

Lots of our customers are beginning to invest, but it’s important to do it the right way.

Invest+ has been designed by investment experts. Our advice will help you understand the right amount to invest, and we’ll assess the level of risk you’re comfortable taking. This allows us to provide a personalised investment recommendation that can help your money grow.

There is a one-off £50 advice fee if you purchase your recommended investment.

We’ve created a simple five-step guide to help you decide if investing works for you.

Understanding risk and reward is crucial to investing. Read our article to learn more.

We have a range of easy-to-read content to grow your confidence in investing.

Our terms and conditions (PDF, 62 KB) cover the Invest+ service. If you choose to proceed, we’ll email these to you and also keep a copy for future reference.

All advice is regulated by the Financial Conduct Authority and covered by the Financial Services Compensation Scheme. The value of investments, and income from them, can fall as well as rise and you might get back less than you invest. Investing for 5+ years helps to reduce the impact of market changes over time.

Our Ready-Made Investments are provided by Embark Investment Services Limited and are protected up to a total of £85,000 by the Financial Services Compensation Scheme.

You can get more information on the FSCS on their website: fscs.org.uk.